michigan sales tax exemption for farmers

You should never use your social security number for retail purchases. And Farmland and Open.

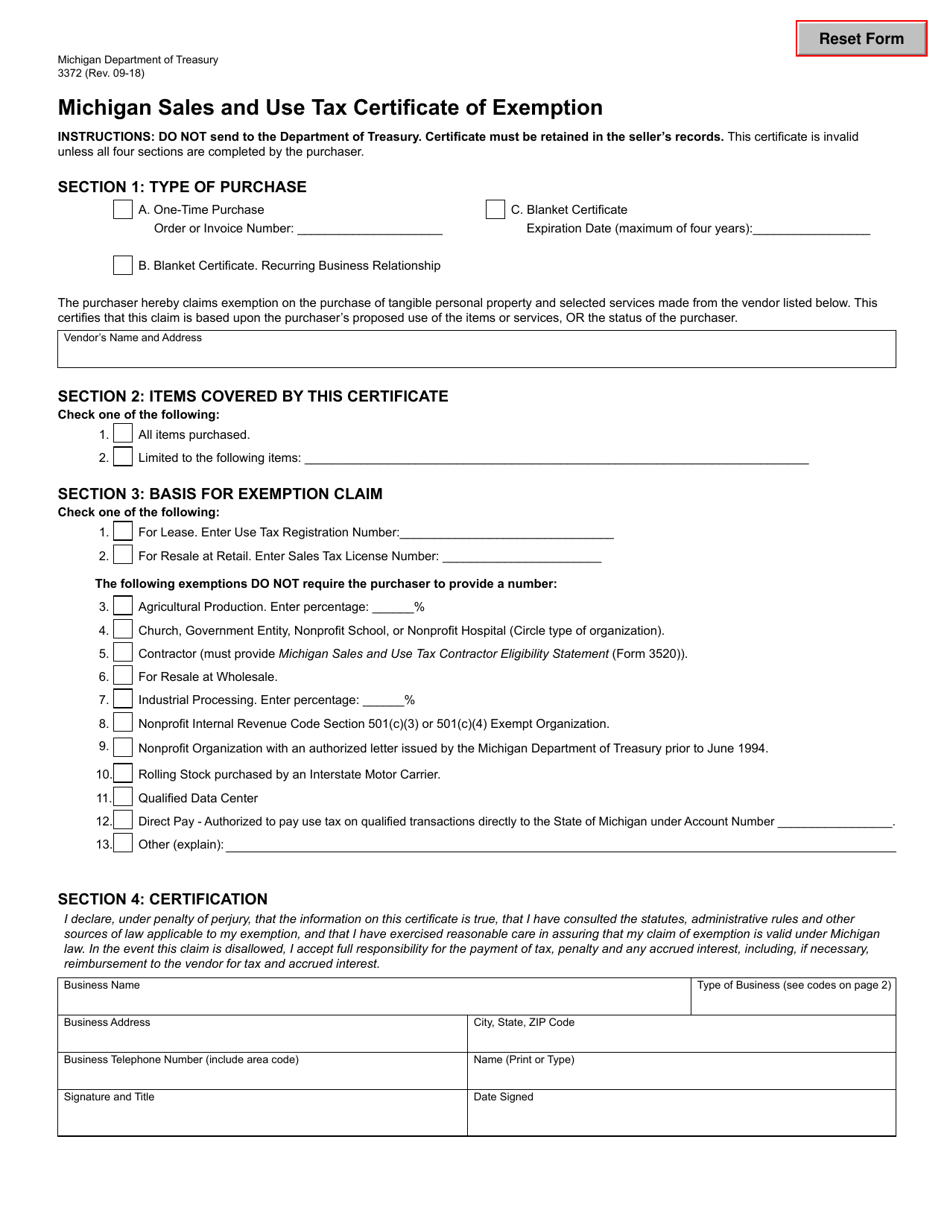

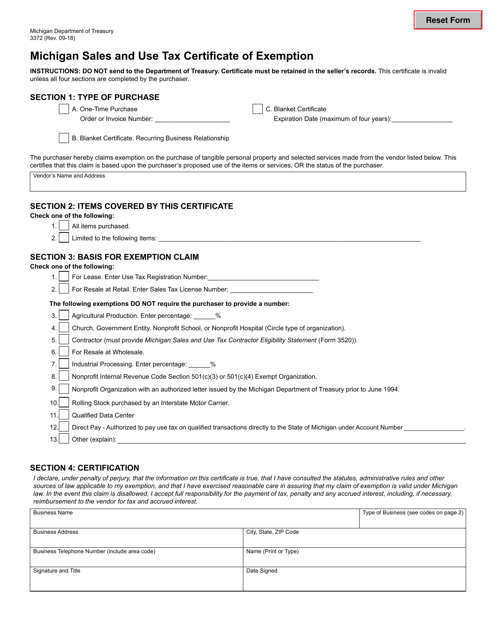

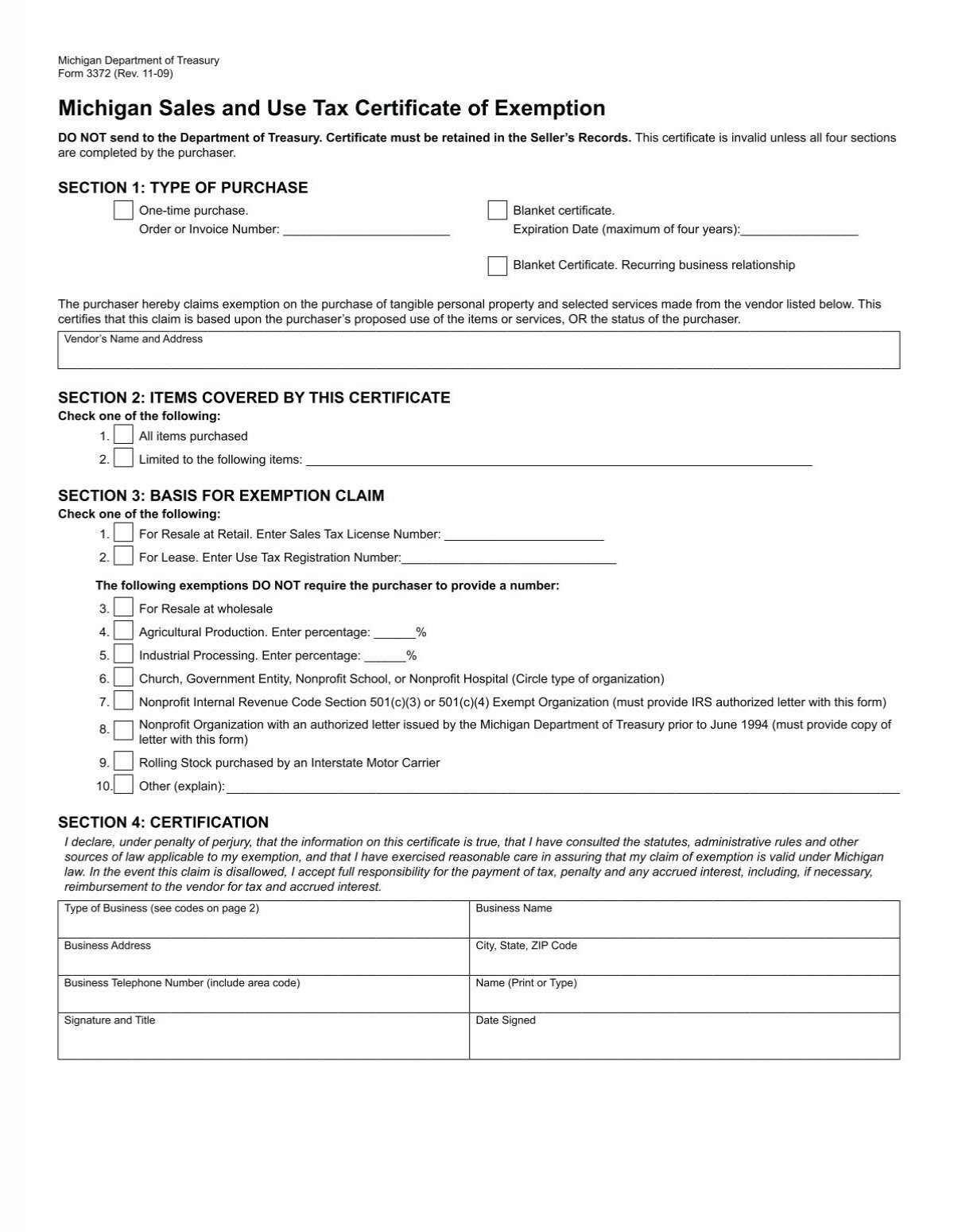

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Prepaid Diesel Sales Tax Rate Effective April 1 2022 the new prepaid gasoline sales tax rate is 202 cents per gallon.

. Several examples of exemptions to the states sales tax are vehicles which have been sold to a relative of the seller certain types of equipment which is used in the agricultural business or some types of industrial machinery. Farms are defined as any place from which 1000 or more of agricultural products were produced and sold or normally would have been sold during the census year. A tax-free weekend prior to the start of the school year for purchasing clothing computers books school supplies footwear etc.

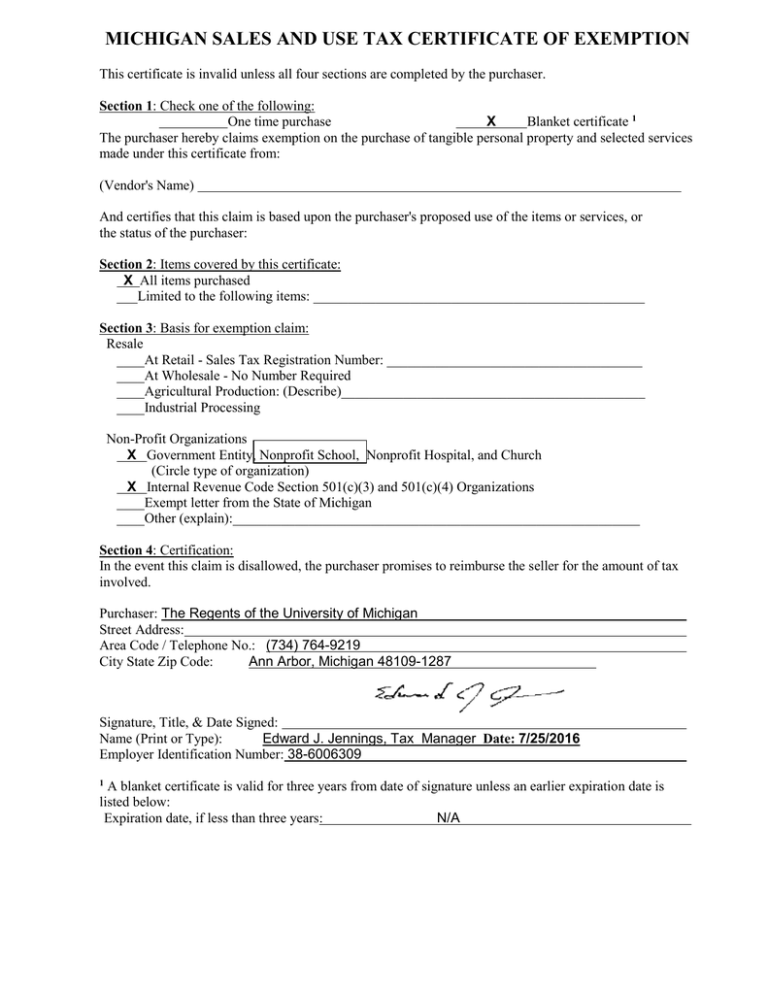

The Michigan Senate today passed legislationunanimously and with bipartisan supportto preserve agricultures existing sales and use tax exemptions. Church Government Entity Nonprot School or Nonprot Hospital Circle type of organization. The 1000 is the gross sales amount.

There is no such thing as a Sales Tax Exemption Number for agriculture. Ii A person who is a partial owner of property. Qualified Agricultural Property Exemption Guidelines.

Contractor must provide Michigan Sales and Use Tax Contractor Eligibility Statement Form 3520. Their sales tax license number must be included in the blank provided on the exemption claim. Tax Exemption Between Relatives.

Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and medicines. The following exemptions DO NOT require the purchaser to provide a number. Retailers Retailers purchasing for resale should provide a signed exemption certificate by completing form 3372 Michigan Sales and Use Tax Certificate of Exemption and check box 1.

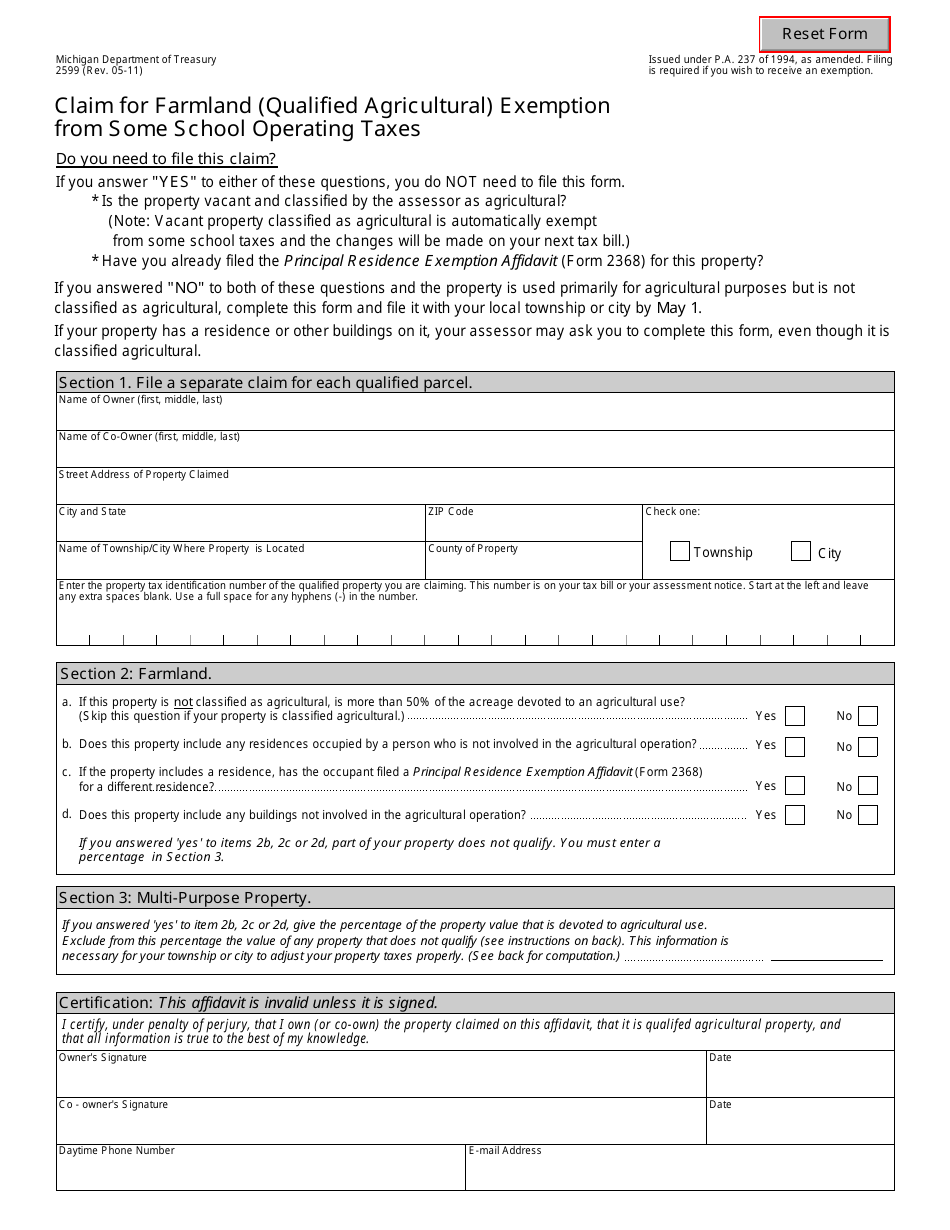

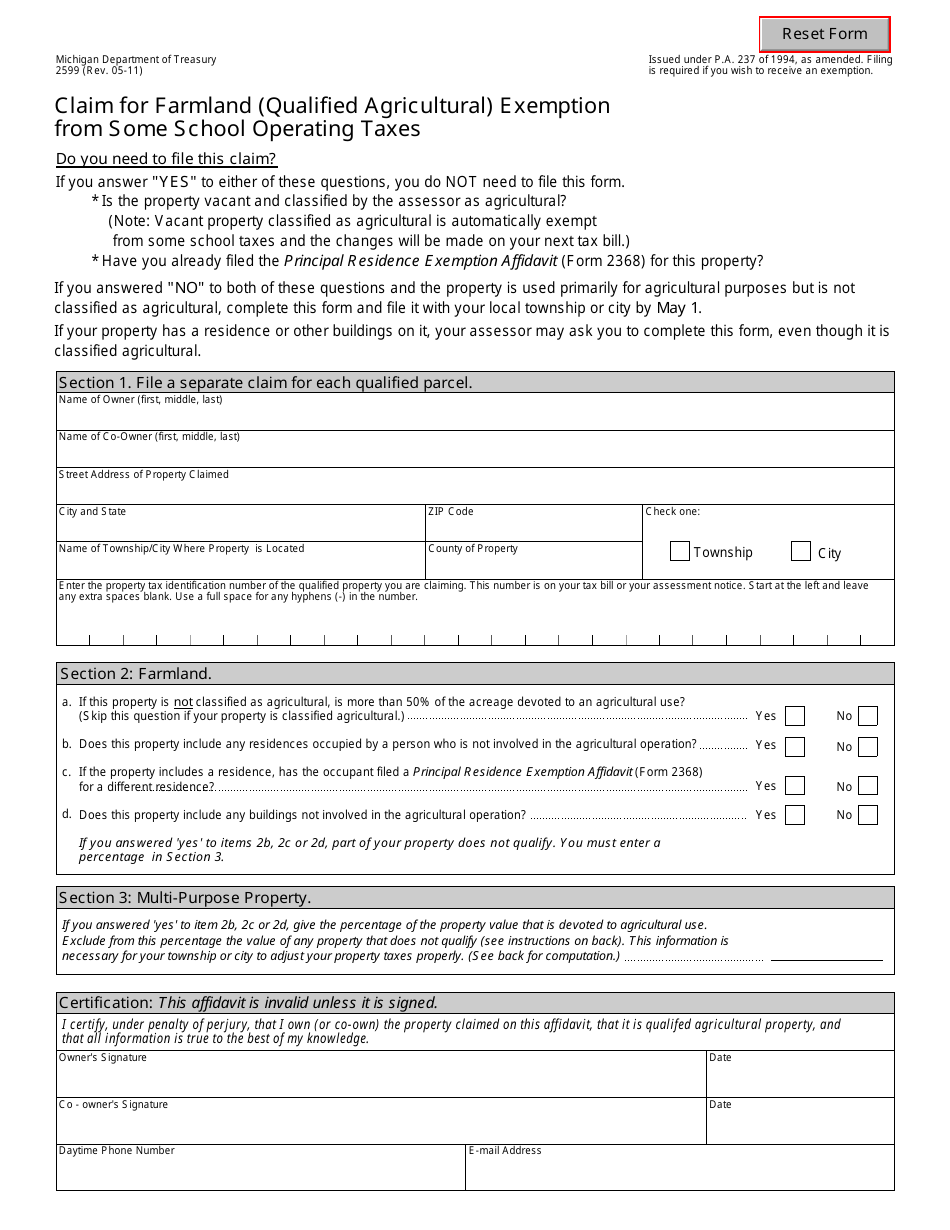

In the State of Michigan there is no requirement for a sales tax exemption number for tangible personal property purchased for agricultural production. Claim for Farmland Qualified Agricultural Exemption for Some School Operating Taxes. Use exists then the property would not be eligible for the exemption.

And farmers should not use your social security number as proof for a sales tax exempt purchase. Tangible personal property could be items like seeds fertilizer spray materials feed and similar items. Farmers across the state can breathe a little easier after Lieutenant Governor Brian Calley signed into law legislation to protect agricultures sales and use tax exemptions and put an end to misinterpretations by the Department of Treasury.

Amendments to clarify the law were pursued by Michigan Farm Bureau MFB in part after recent farm audits exposed misinterpretations by the Department of Treasury. You can complete a Sales and Use Tax Certificate of Exemption form 3372 from the Michigan Department of Treasury and show it to vendors when making pruchases for your farm. Farms are defined as any place from which 1000 or more of agricultural products were produced and sold or normally would have been sold during the census year.

Strongly supported by Michigan Farm Bureau MFB House Bills 4561 and 4564 are now officially Public Acts 113 - 114 of 2018. Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would be exempt from sales tax. Request to Rescind Qualified Agricultural Property Exemption.

Interstate fleet motor carriers who qualify for exemption may claim exemption from sales or use tax by providing the seller or lessor with the prescribed Michigan Sales and Use Tax Certificate of Exemption form 3372. Parent natural or adoptive. An immediate family member is defined as.

Notice of Intent to Rescind the Qualified Agricultural Property Exemption. For Resale at Retail in Section 3 Basis for Exemption Claim. There is no such thing as a Sales Tax Exemption Number for agriculture.

10 million acres of agricultural land in Michigan contain 56000 farms which produce 57 billion in products annually. In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer. There are a few key points that need to be made regarding this matter.

This rate will remain in effect through April 30 2022. Effective April 1 2022 the new prepaid gasoline sales tax rate is 176 cents per gallon. Qualified Agricultural Property Exemption Guidelines.

USDA defines a farm as any place from which 1000 or more of agricultural products were produced and sold or. This rate will remain in effect through April 30 2022. For Resale at Wholesale.

A continuation of the agriculture sales tax exemption for the equine industry. If you purchase or acquire a vehicle from another person 6 tax is due of the full purchase price or fair market value whichever is greater. You should never use your social security number for retail purchases.

The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372. I A person who owns property or who is purchasing property under a land contract. These farms and other lands eligible for favorable treatment under certain legislation can take advantage of real property tax relief and transfer emptions under the General Property Tax Act MCL 2111 et seq.

The buyer or lessee would check the box Rolling Stock purchased by an Interstate Motor Carrier. Several examples of exceptions to this tax are vehicles which are sold specifically to relatives of the seller certain types of equipment which is used in the agricultural business or some types of industrial machinery. Ownership MCL 2117dda defines owner for the purposes of the qualified agricultural exemption as any of the following.

First there is no such thing as a sales tax exemption number for agriculture. Supporters of the FAIR Tax providing education and analyzing the proposals impacts and benefits on agriculture. No tax is due if you purchase or acquire a vehicle from an immediate family member.

According to the Internal Revenue Service if you gross 1000 or more in agriculture sales per year you are considered a farm.

Michigan Sales And Use Tax Certificate Of Exemption

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Mi Sales Tax Exemption Form Animart

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

2021 Form Mi Dot 3372 Fill Online Printable Fillable Blank Pdffiller

Fillable Online Finserv Uchicago Michigan Form 3372 Tax Fax Email Print Pdffiller

Sales And Use Tax Regulations Article 3

Form 2599 Download Fillable Pdf Or Fill Online Claim For Farmland Qualified Agricultural Exemption From Some School Operating Taxes Michigan Templateroller